October 22, 2025 | New York

U.S. stocks edged lower on Wednesday but remained close to record highs as investors weighed mixed corporate earnings, global economic uncertainty, and another sharp fall in gold prices. Despite muted trading, the mood across Wall Street stayed largely positive as traders continued to bet that the Federal Reserve could begin easing monetary policy before year-end.

The S&P 500 slipped 0.1 % after briefly touching a new intraday high early in the session. The Dow Jones Industrial Average lost about 65 points, or 0.1 %, while the Nasdaq Composite dropped around 0.3 %. The modest declines came as investors digested a series of third-quarter earnings reports that painted a complex picture of consumer spending and corporate resilience.

Financial stocks helped limit losses, with several major banks posting results that exceeded expectations. Capital One, Western Alliance, and JPMorgan Chase all reported stronger balance sheets, with loan demand and credit quality showing modest improvement. Analysts said the figures helped calm fears about regional banking stability after months of volatility in the sector.

The technology sector, which has driven much of 2025’s market gains, experienced sharper swings. Netflix fell more than 8 % after reporting weaker-than-expected profits and subscriber growth, while Texas Instruments dropped nearly 8 % on cautious guidance for semiconductor demand. In contrast, Intuitive Surgical surged 16.5 % after announcing record quarterly revenue and expanding margins, providing a lift to health-tech shares.

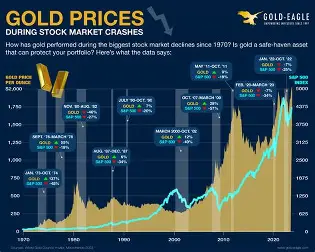

Beyond equities, gold prices fell again as investors retreated from safe-haven assets. The metal slipped 0.8 % to about $4,075 per ounce, extending a week-long decline that has erased much of its recent rally. Gold remains up more than 40 % this year but is now down nearly 15 % from its September peak, as stronger equities and easing geopolitical fears reduced demand for defensive assets.

Analysts said the recent pullback in gold reflects improving investor sentiment about the global economy and a belief that inflationary pressures are stabilizing. However, others warned that volatility could return quickly if geopolitical tensions flare or U.S. economic data weakens further.

Market sentiment was also shaped by uncertainty over the U.S. government’s temporary data blackout following the partial shutdown earlier this month. The delay in key reports, including GDP and inflation figures, has left investors and policymakers navigating with limited visibility. That uncertainty could influence the Federal Reserve’s next moves when it meets to discuss monetary policy later this quarter.

Energy stocks were mixed as oil prices steadied near $89 per barrel, supported by tight supply forecasts but capped by concerns about slowing demand in Europe and Asia. Treasury yields held steady, with the 10-year yield at 4.31 %, as bond traders awaited fresh signals from the Fed.

Despite the cautious tone, strategists said the market’s resilience reflects investor optimism about corporate earnings and potential interest rate cuts in 2026. “The rally has legs as long as the data doesn’t deteriorate sharply,” said one New York-based market analyst. “But valuations are high, and expectations are even higher , that’s where the risk lies.”

As Wall Street approaches the final quarter of 2025, attention is turning to consumer spending ahead of the holiday season. A recent survey from the University of Michigan showed that most Americans expect higher prices this year but remain willing to spend on essentials and travel, a sign that household confidence is holding up despite inflation concerns.

For now, markets remain in a delicate balance: equity investors are confident enough to stay invested, but cautious enough to watch every move from the Federal Reserve and global central banks. With gold’s retreat and stocks hovering near all-time highs, the next few weeks could determine whether this year’s rally continues or finally runs out of momentum.